BARRY CALLEBAUT - Sold off by 18% to support at 785.

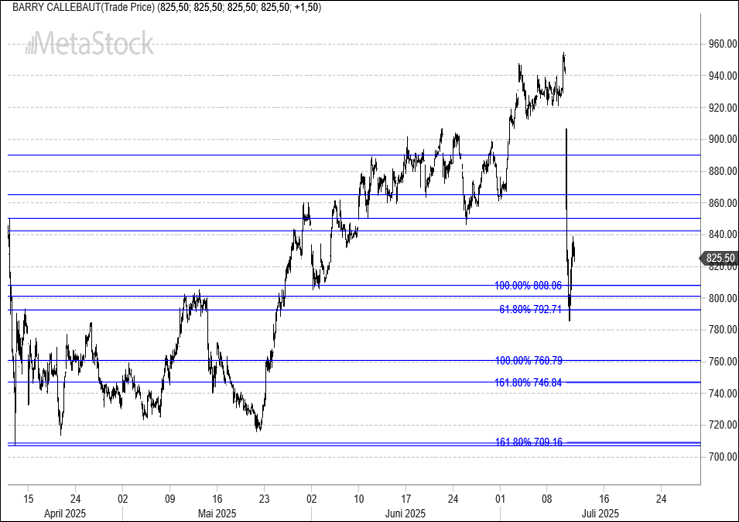

Shares of chocolate company Barry Callebaut began trading on Thursday with heavy losses. Sales in the first nine months of the 2024/25 fiscal year fell even more sharply than feared, and management is lowering its targets again. The stock fell 18% from the intraday high of July 9 at 954.50 to yesterday’s intraday low at 788.

Interestingly enough, this decline retraced 61.80% of the rise from April 11 at 707.50 to the high of July 7 at 952. The exact retracement was at 800 and the intraday low was 786.

Based on the Fibonacci correlation levels, Barry would trigger SELL signals if the supports at 800 and 785 and 745 and 700 are broken.

BUY signals would be triggered if the resistances are broken at 843, 852, 867 and 895.