APPLE - 25% levy on imported iPhones.

U .S. President Donald Trump threatened on Friday to ratchet up his trade war again, pushing for a 50% tariff on European Union goods starting June 1 and warning Apple he may slap a 25% levy on all imported iPhones bought by U.S. consumers.

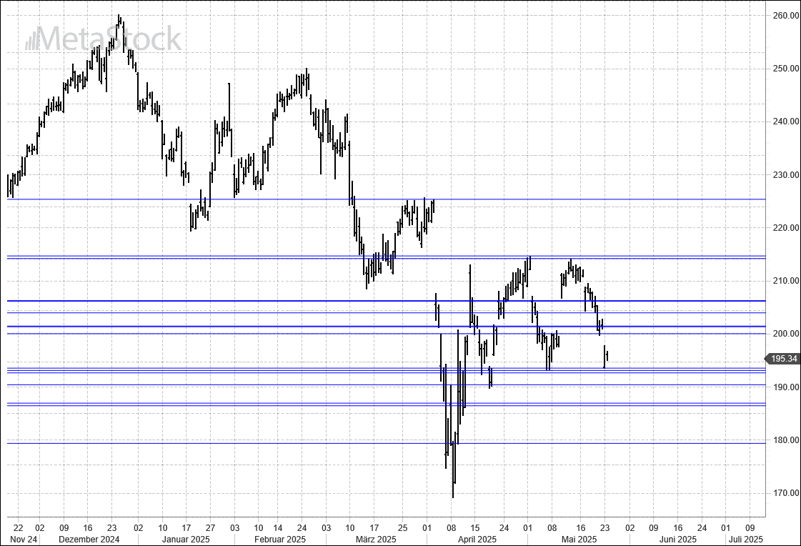

Below, I picture the 4-hour chart of Apple with the Fibonacci supports and resistances.

The two points of relevance are the top on December 26, 2024 at 260.10 and the low on April 8, 2025 at 169.21 and the high of May 1, 2025 at 214.56. The decline reduced the price of Apple by 35%. In the rebound from the April low, Apple rose by 27%. From here, Apple has two options.

1) It could break the consolidation of the past 6 weeks to the downside and trigger SELL signals with the break of the supports at 192.50, 190 and 186 and extend the downtrend below 179 and below the April low at 169.21. Long-term supports are at 157 and 122.

2) It could break the consolidation to the upside and trigger BUY signals with the break of the resistances at 204-206.50, 215 and 226. A rise above 226 would mean that the former long-term uptrend could be reinstated and break the December top at 260.10.

AS LONG AS THE RESISTANCE AT 215 IS NOT TAKEN OUT, I GIVE THE BEARISH SCENARIO A SLIGHTLY HIGHER PROBABILITY.